Industry Pulse - Deal Momentum and Strategic Consolidation

Crypto M&A activity continued to accelerate in recent weeks as major firms pursued strategic acquisitions to expand institutional reach. Coinbase announced a $375 million deal to acquire crypto investment platform Echo, reinforcing its focus on professional trading and asset management. Around the same time, FalconX acquired ETF manager 21Shares, marking a significant move toward integrating traditional investment products with digital asset infrastructure.

Overall, industry deal volume has surged compared to last year, reflecting a shift from fragmented growth to large-scale consolidation. As regulatory clarity improves and institutional capital deepens, the next wave of acquisitions is expected to focus on infrastructure, compliant yield platforms, and regulated investment products.

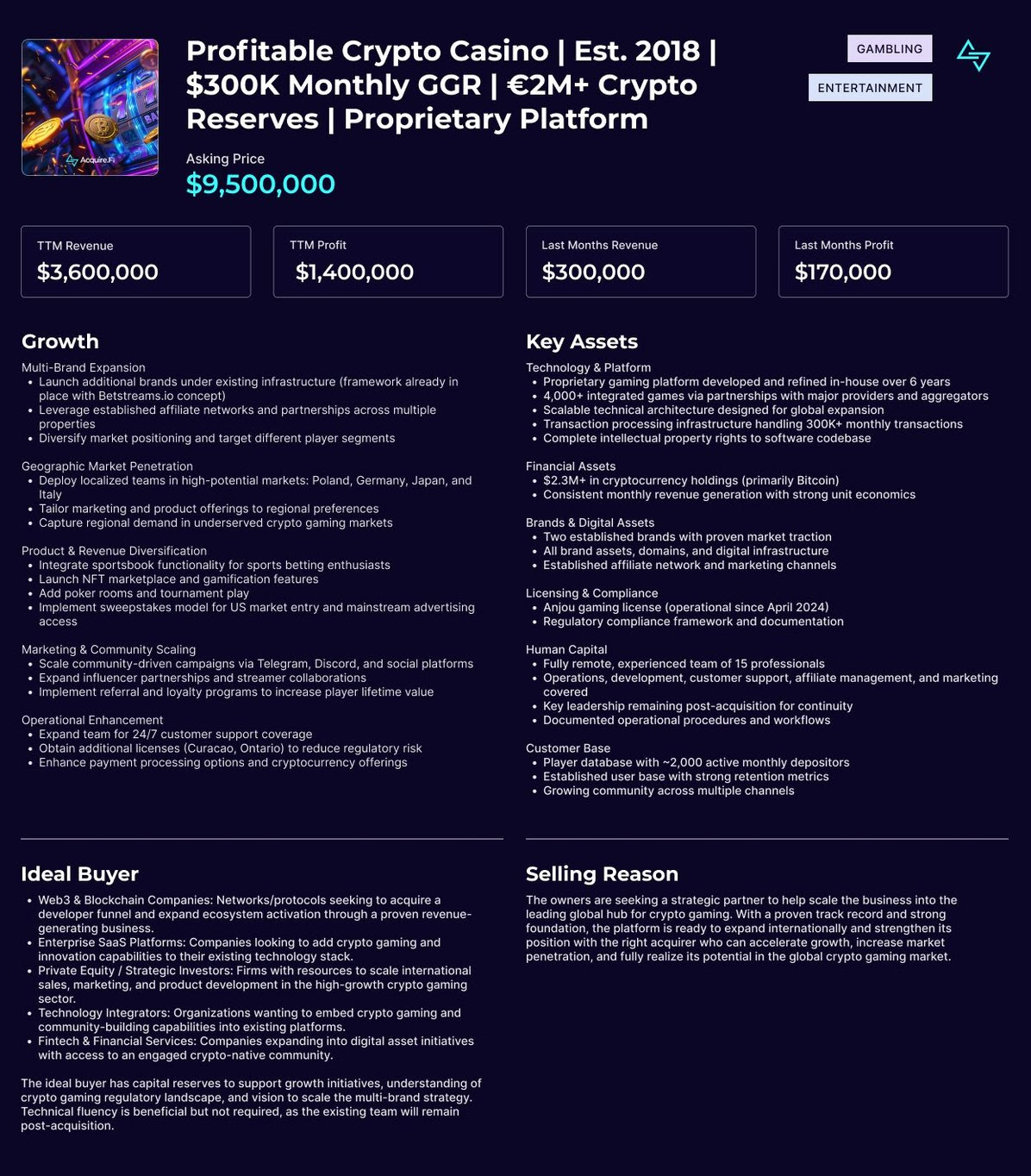

Mergers & Acquisitions Deal of the Week

This profitable crypto casino combines a proven iGaming model with on-chain transparency and instant settlement. Offering a full suite of casino games, sports betting, and integrated crypto payments, the platform delivers a seamless user experience with fast transactions and verifiable fairness.

With strong recurring revenue and established player retention, the business is positioned for continued growth as blockchain adoption expands in online gaming. Its scalable architecture, active user base, and ready-to-market infrastructure make it a strategic acquisition for investors seeking exposure to the rapidly growing crypto entertainment sector.

For buyers, this represents a chance to acquire a revenue-generating, fully operational casino platform in one of the most resilient and high-margin verticals of Web3.

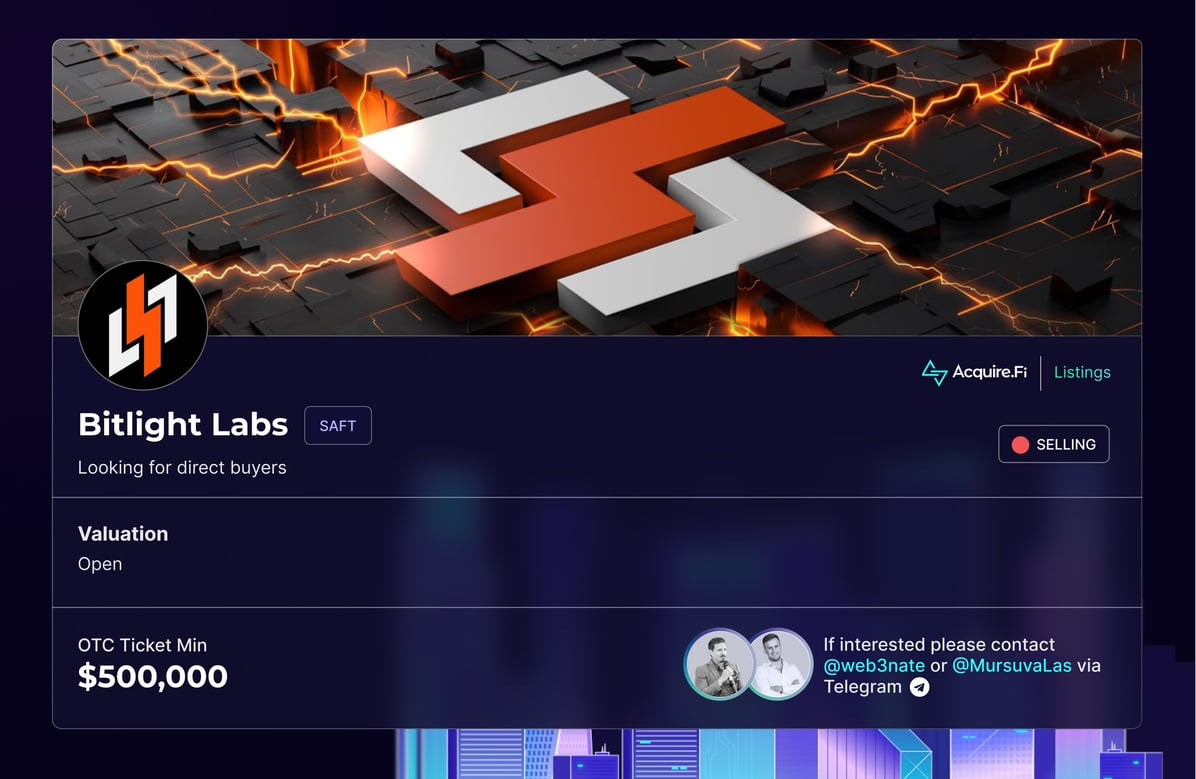

Secondary Market Opportunity: Bitlight

Bitlight is developing an EVM-compatible Layer 2 network for Bitcoin, combining Bitcoin’s security with Ethereum’s flexibility to enable smart contracts, DeFi protocols, and tokenized assets on BTC. The project aims to extend Bitcoin’s utility beyond simple value storage by allowing developers to deploy decentralized applications directly on its Layer 2 framework, with near-zero gas fees and full interoperability with existing EVM ecosystems.

Backed by strong early investor interest, Bitlight has already secured over $20 million in funding and is positioning itself alongside other leading Bitcoin Layer 2 initiatives driving the growing Bitcoin DeFi narrative. Its technical roadmap focuses on scalability, cross-chain composability, and liquidity bridging, which are key elements as institutional demand for programmable Bitcoin exposure increases.

.webp)