2025 - A Buyers Market!

The cryptocurrency mergers and acquisitions (M&A) market has been heating up in 2025, driven by strategic consolidation, regulatory clarity, and a push to scale infrastructure and services. A flurry of high-profile deals marks this year, with Coinbase is leading the charge through its record-breaking $2.9 billion acquisition of derivatives exchange Deribit, the largest crypto M&A deal to date, enhancing its offerings for institutional traders. Robinhood also expanded its global footprint with a $200 million purchase of Bitstamp, gaining access to customers across the EU, UK, and Asia. Ripple bolstered its institutional capabilities with a $1.25 billion acquisition of prime brokerage firm Hidden Road, aiming to scale the XRP Ledger for global markets. Here at Acquire.fi, the hot streak continues. We’ve been seeing a record number of new listings and LOIs as companies seek to capitalize on favorable valuations, fueled by institutional interest, and secure strategic positions in this highly competitive landscape.

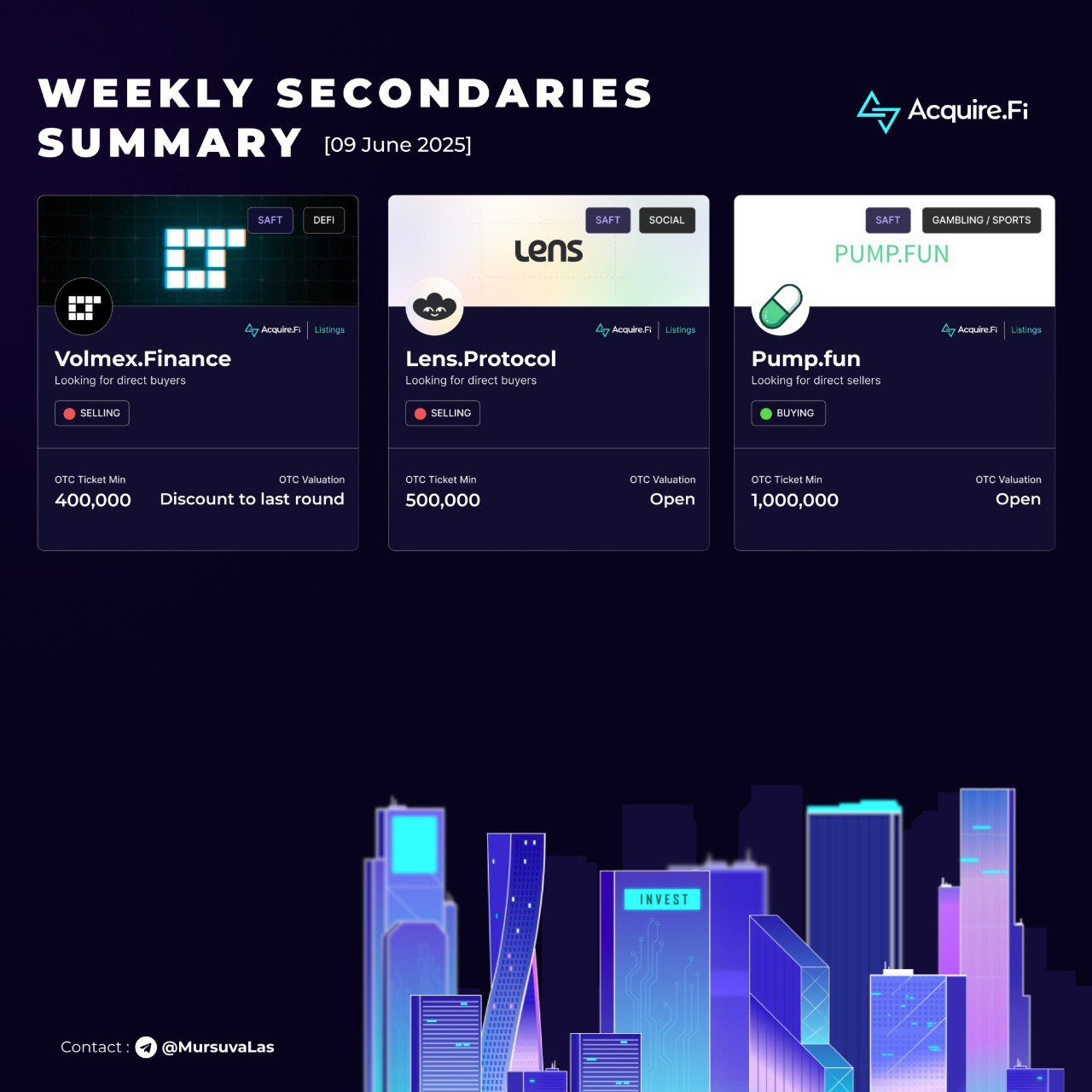

Meanwhile, the over-the-counter (OTC) market in crypto is increasingly becoming a buyer’s market, as foundations and projects in the altcoin space search for liquidity to fuel growth amid a lagging altcoin market. Buyers are seeing stellar terms on top projects, allowing them to cherry-pick deals. This serves to further intensify competition among foundations and cap tables to offer more creative and competitive OTC structures.

Check out some of our top deals this week below. For additional information on any deal in particular please reach out to info@acquire.fi with the subject line referencing the deal you are interested in and we’ll get back ASAP!

M&A Deal of the Week

Secondaries Deal of the Week

.webp)