Crypto Capital Flows Surge: ETH Outpaces BTC, Ripple Eyes $200M Deal

This week, institutional demand continues to drive a tidal wave of capital into crypto ETFs, with Ethereum ETFs outpacing Bitcoin across multiple metrics. Ethereum witnessed a historic $3.75 billion in exchange inflows last week, primarily channelled through BlackRock-linked assets. Spot Ethereum ETFs have also enjoyed their biggest single-day net inflow in U.S. history, over $1 billion, and over $3 billion in net inflows across early August. Overall, the weekly total net inflows for ETH ETFs reached $2.91 billion, outshining Bitcoin’s $1.34 billion in the same period. Meanwhile, Bitcoin saw a rollercoaster: pushing a new all-time high near $124,500, before easing back toward the $119k range amid profit-taking and policy-driven market jitters. These flows signal a decisive shift: Ethereum is now commanding the spotlight as institutional treasuries diversify and chase yield and regulatory clarity.

On the M&A and OTC front, activity in the Web3 space is accelerating as established players look to strengthen infrastructure and expand global reach. Ripple announced plans to acquire Rail, a stablecoin-powered cross-border payments platform, in a deal valued at $200 million, with regulatory approval expected later this year. Meanwhile, OTC desks continue to see rising institutional demand for large-block ETH and BTC trades, driven by ETF inflows and treasuries seeking exposure without moving spot markets. This blend of strategic acquisitions and deepening OTC activity underscores the increasing maturity of the crypto markets as traditional finance and Web3 converge.

Interested in acquiring new revenue streams, users or TVL? Or looking for the right buyer to acquire your project? We'd love to chat. Drop us an email jan@acquire.fi or Connect on TG @MursuvaLas.

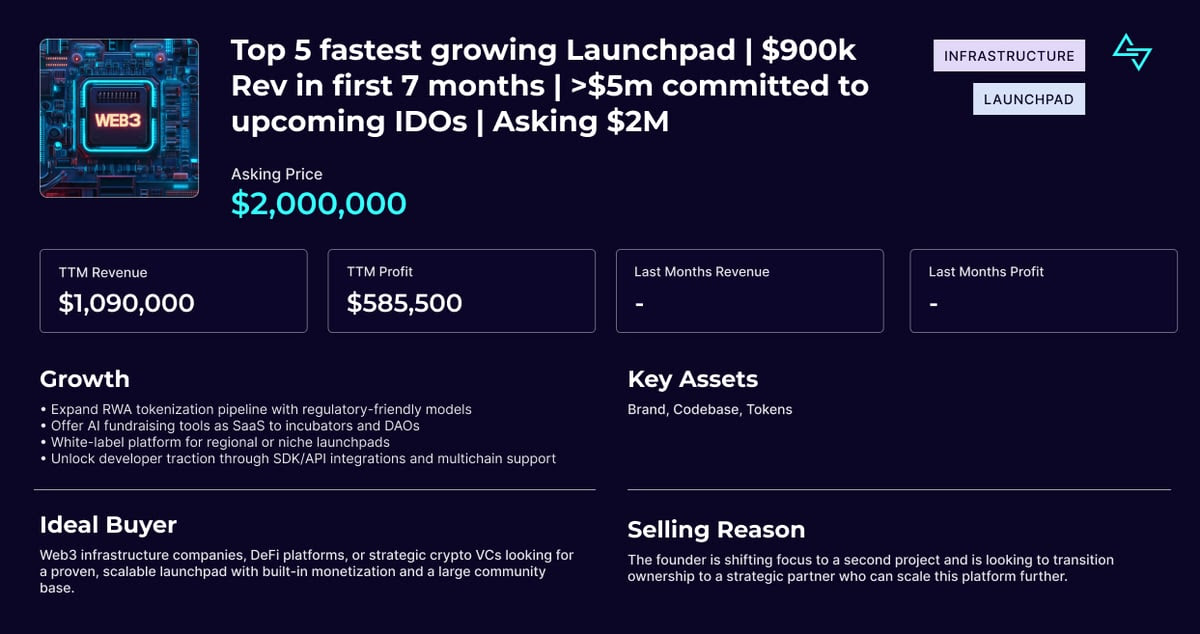

Mergers & Acquisitions Deal of the Week

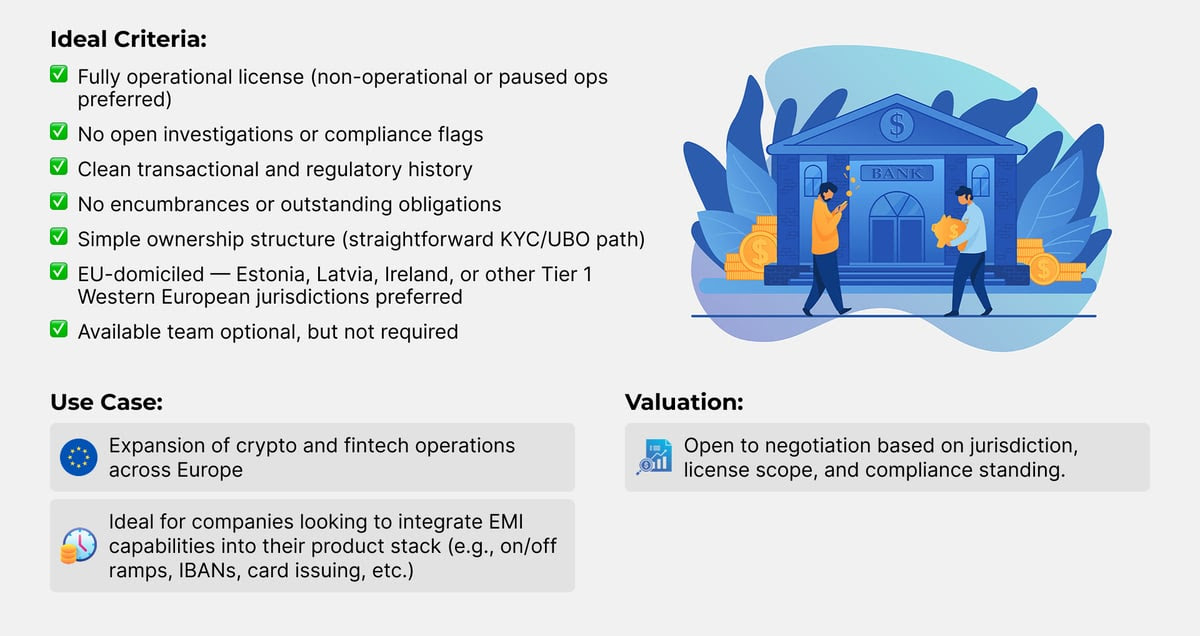

M&A Buy-Side Request

We're actively looking to acquire a fully licensed Electronic Money Institution (EMI) in the EU.

.webp)